The Challenge

In initial research involving 3,000 businesses, HSBC discovered a critical gap in financial management for SMEs. Around 70% of their customers relied on manual processes, primarily Excel spreadsheets, to track finances. Many also depended on external bookkeepers and accountants to interpret their financial health.

As the primary bank for these businesses, HSBC had access to their transaction data—presenting a unique opportunity to evolve from a traditional banking provider into a trusted financial advisor. However, to achieve this, HSBC needed a way to consolidate financial data into a single, intuitive platform that could deliver real-time insights.

The solution

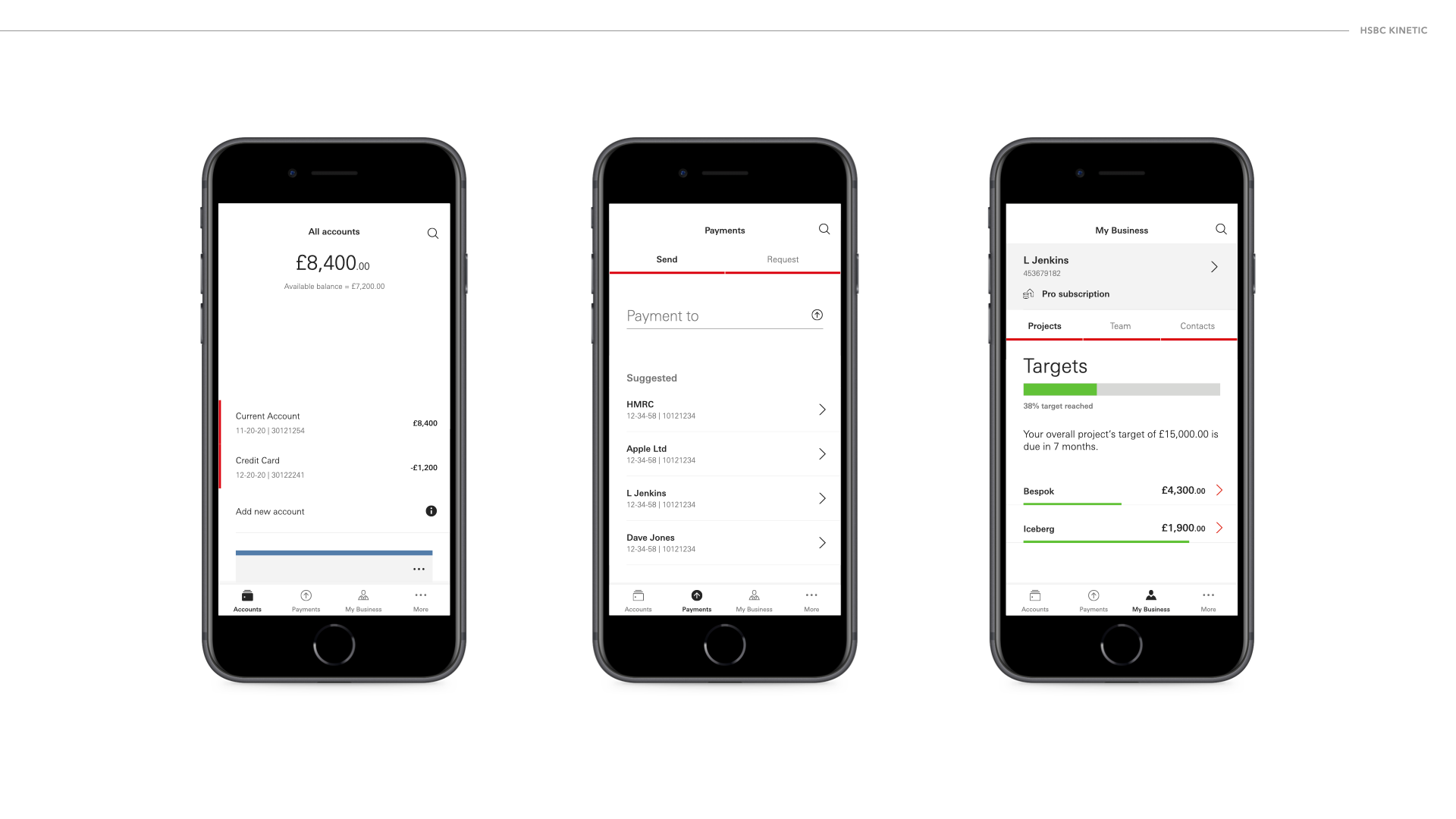

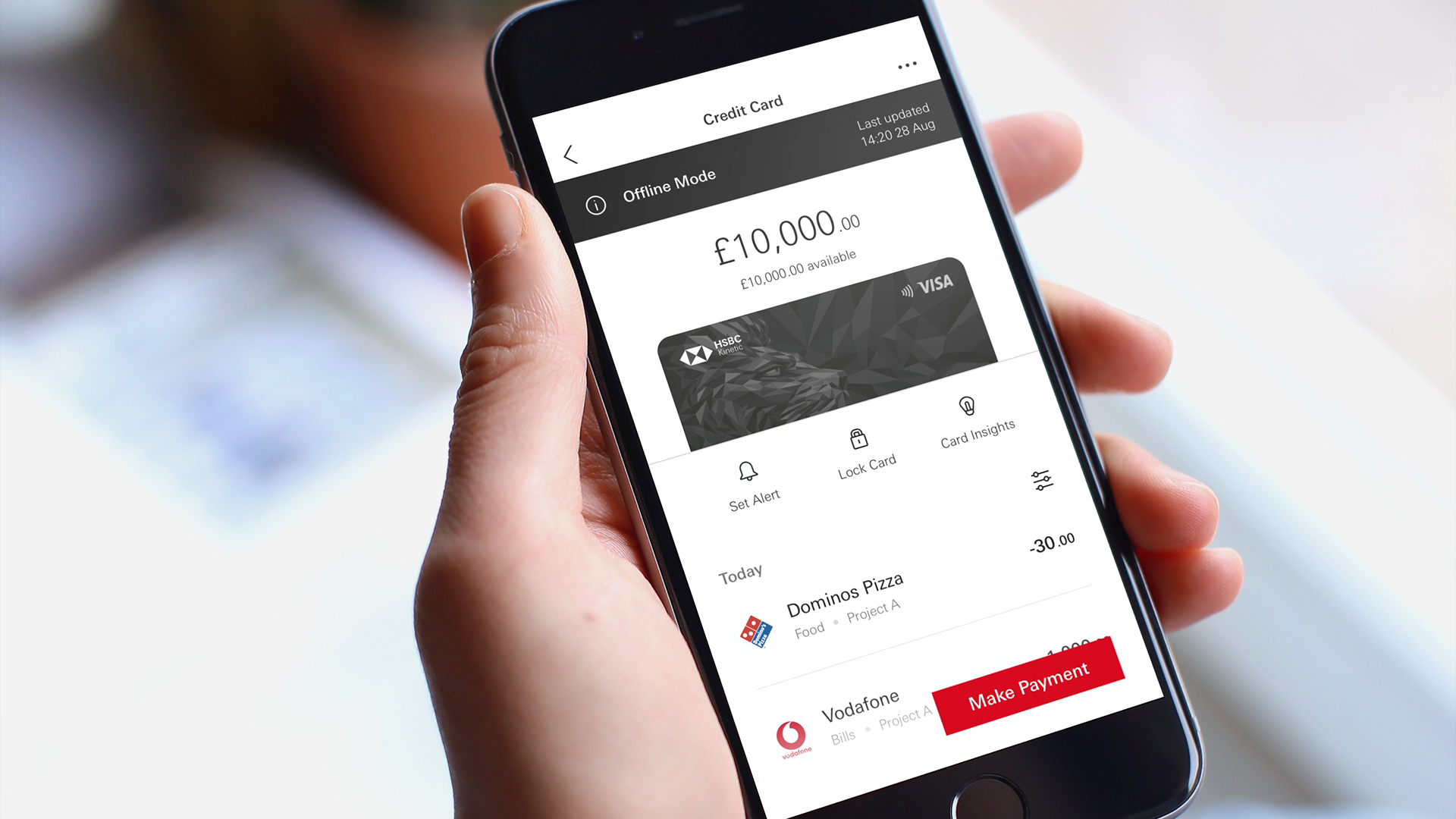

Partnering with Strands, HSBC launched Kinetic—a digital, app-only banking platform tailored for SMEs. The solution integrated external accounting data, providing businesses with a unified view of their finances.

Built in an agile, cloud-based environment, Kinetic offers:

Automated onboarding

In-app overdraft facilities

A controllable debit cardAdvanced budgeting and cash flow forecasting tools

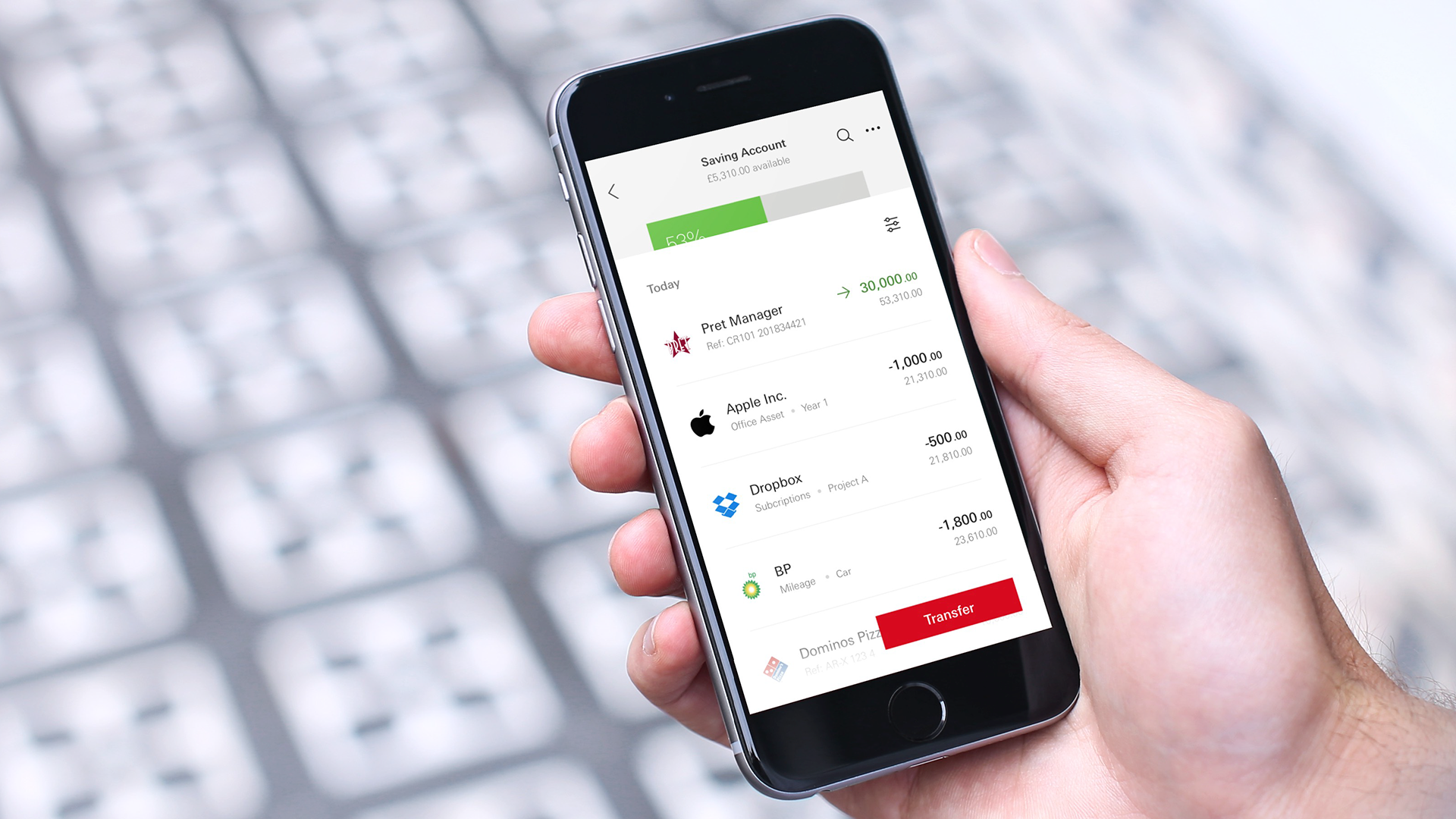

A key feature is Kinetic’s transaction categorization engine, which aligns with HMRC (UK tax authority) standards. By automating expense categorization, the platform saves business owners hours of manual reconciliation each month. Users gain a clearer understanding of their spending patterns, while dynamic analytics provide monthly breakdowns of expenditure changes across different categories.

With Kinetic, HSBC empowers SMEs to make smarter financial decisions—reducing administrative burdens and enhancing financial visibility.

"Iceberg keeps you and your small business moving forward.”

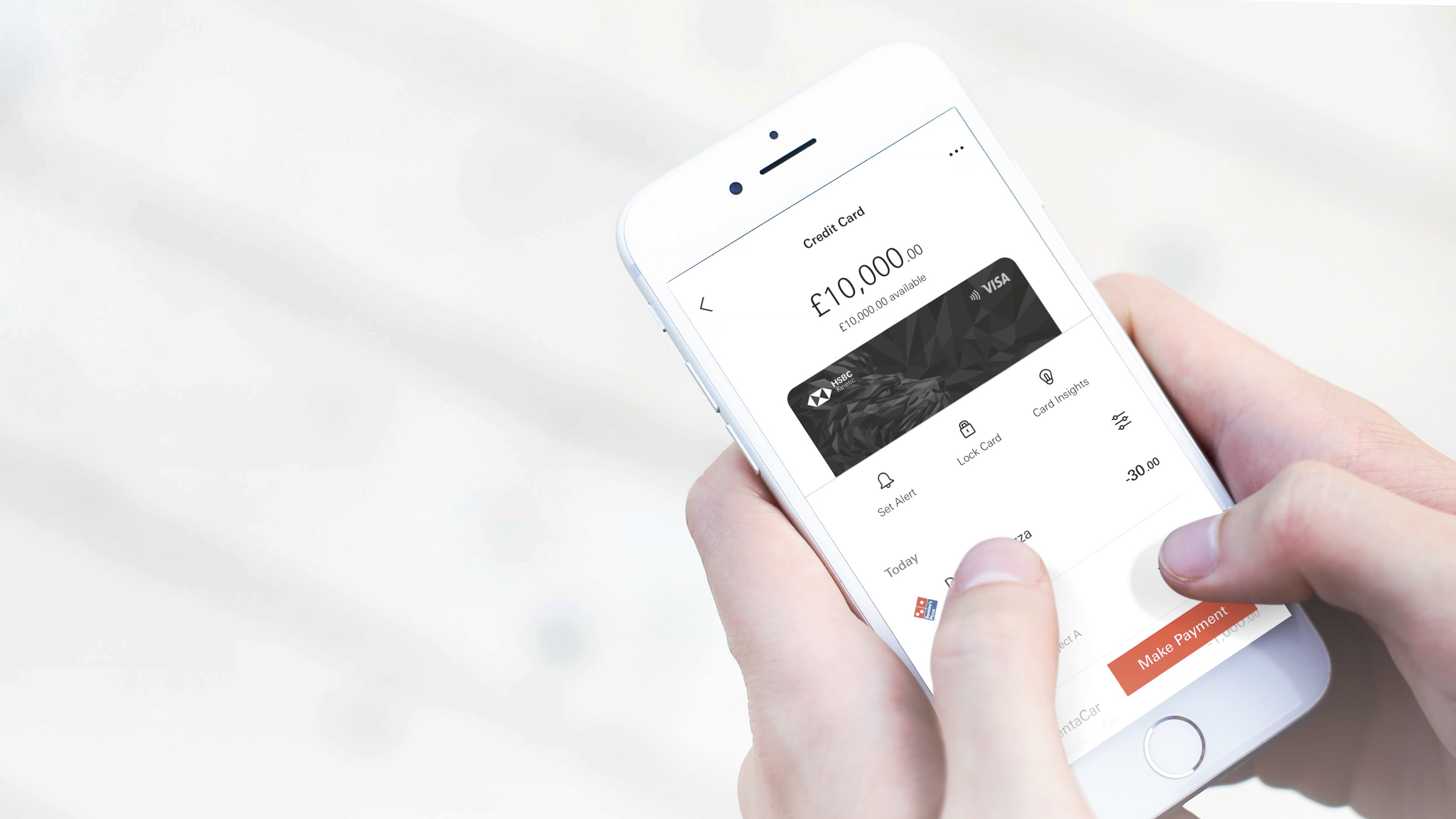

As part of project Iceberg, I contributed to the Cards workstream, focusing on optimizing the user experience for SME cardholders. My key responsibilities included:

Designing intuitive transaction details – Iterating on UX concepts to ensure clarity and actionable insights for business owners.

Defining core features – Shaping the transaction list and card account homepage to align with Kinetic’s goal of simplifying financial management.

By refining these elements, I helped deliver a seamless experience that empowers SMEs to track spending efficiently, reducing manual effort and improving financial visibility.

A New visual style

We partnered with Publicis Sapient to create a new visual language for the client and their new app.

We called this the Kinetic Design System.

It focused on creating a simpler, cleaner palette with emphasis on keeping the user honed in on quick task task-focused things, one at a time.

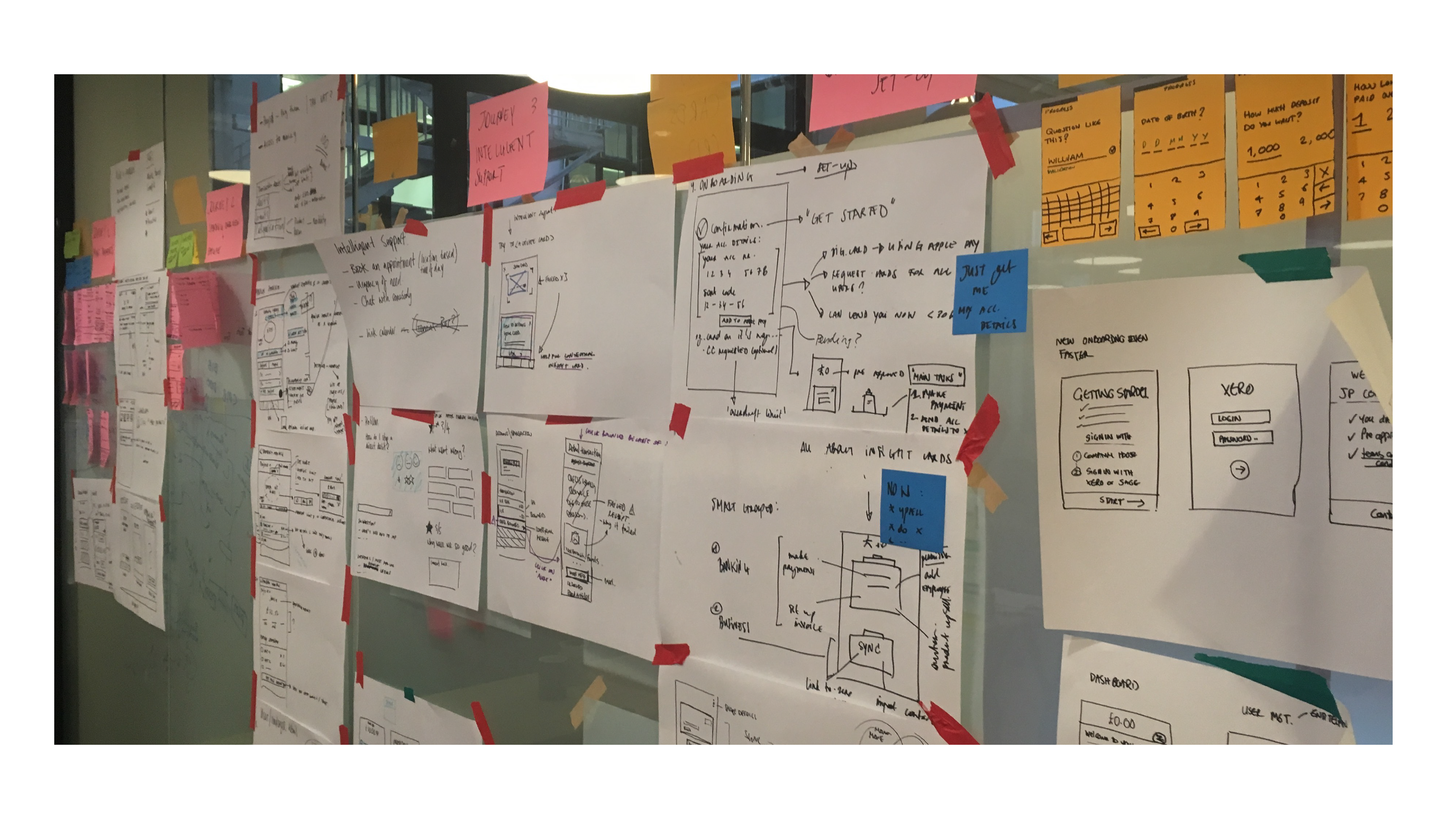

How did we do it

The process for creating the new visual language was broken down into phases to reduce the friction for all the teams and to ensure a cohesive and structured library could be created.

One of the first tasks was to establish what the app framework would be. This entailed defining the ideal navigation experience (both core and contextual), establishing the correct hierarchy/levels and creating the insight and feedback system.

What followed after this initial skeleton was determining the key tenets of the design system.

These include but arent limited to:

These include but arent limited to:

The spacing system (padding, incremental rules)

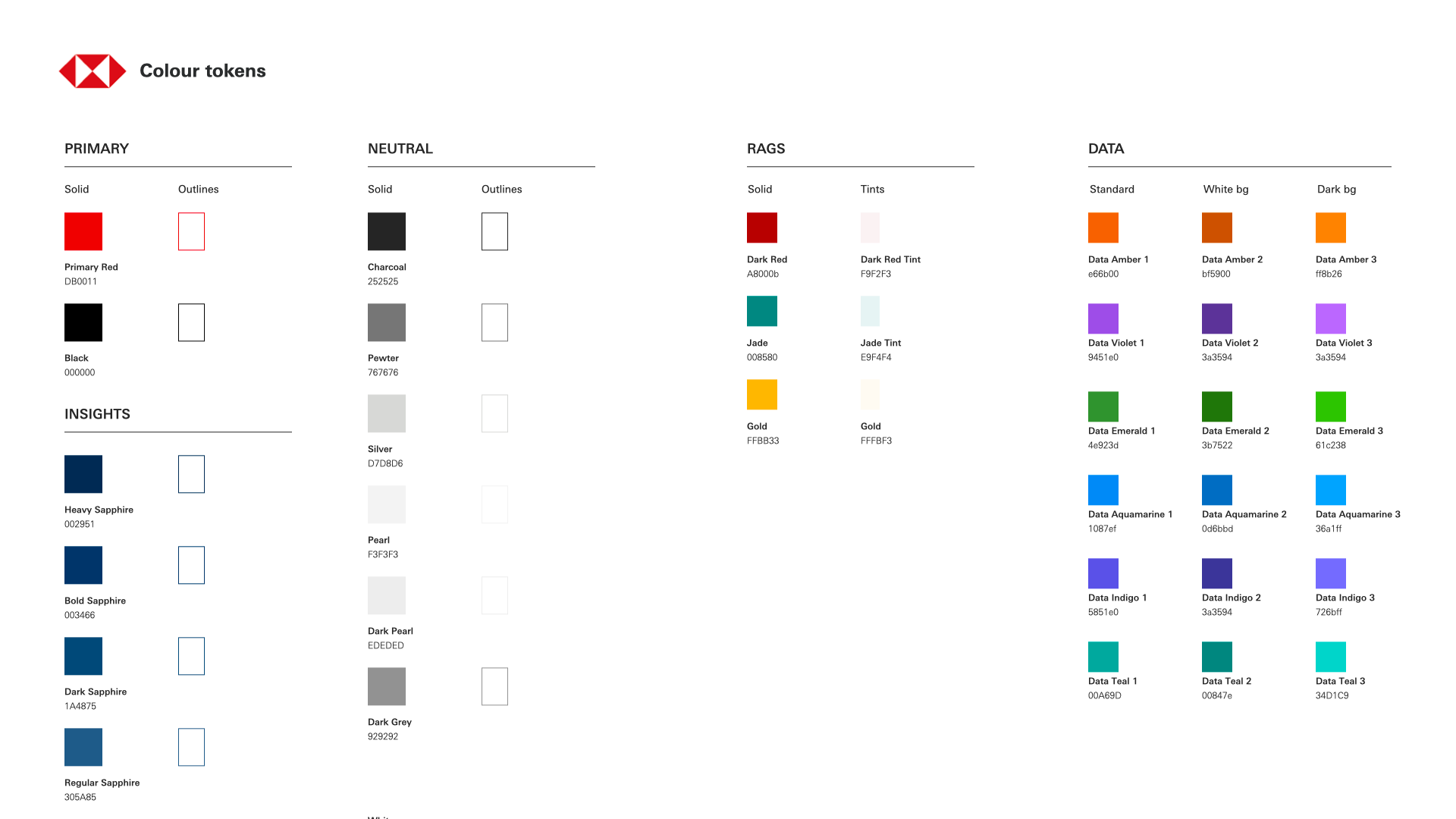

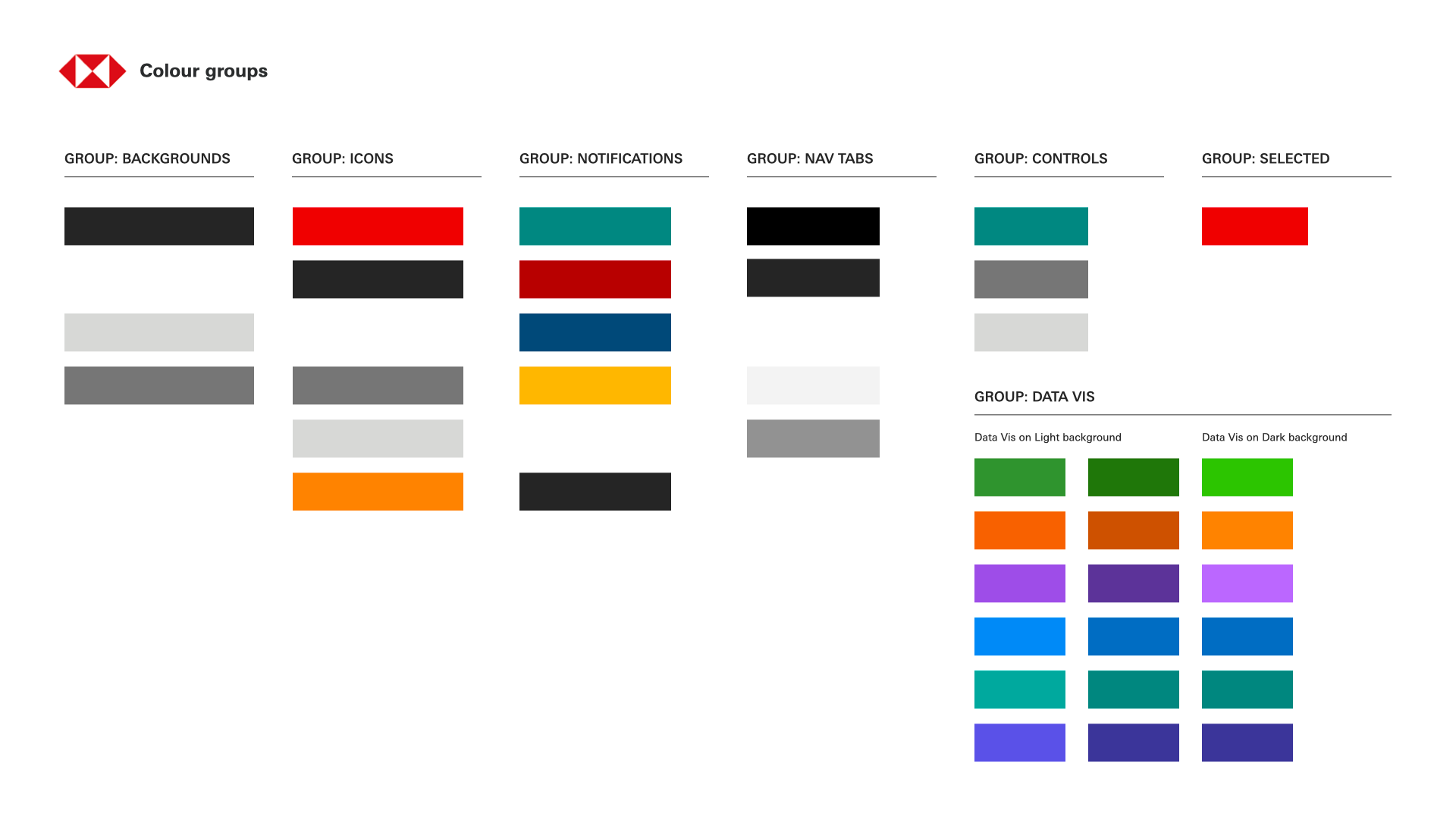

The Colour library (the palette and usage)

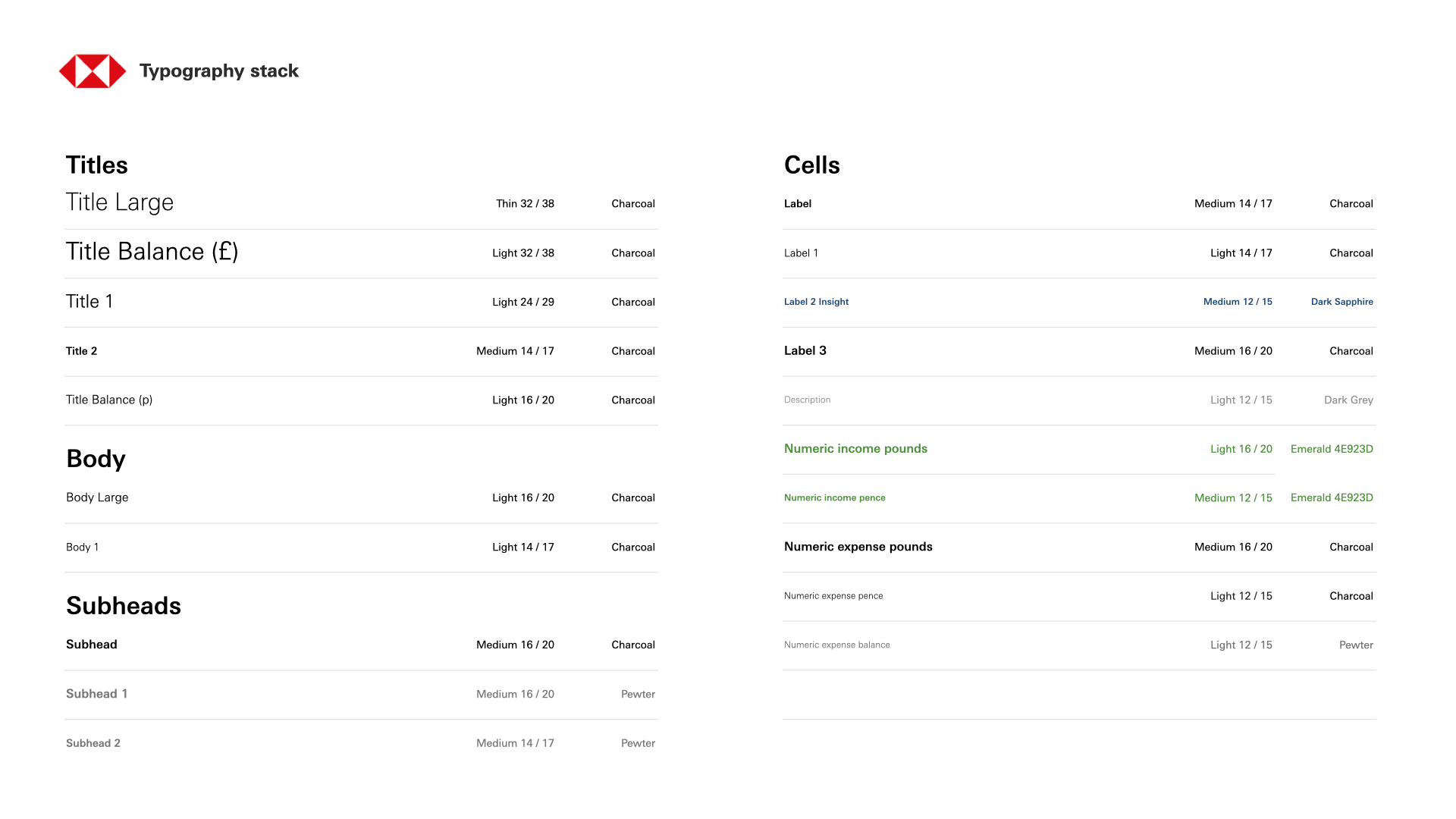

and typography (usage, weights, text colours etc)

The Colour library (the palette and usage)

and typography (usage, weights, text colours etc)

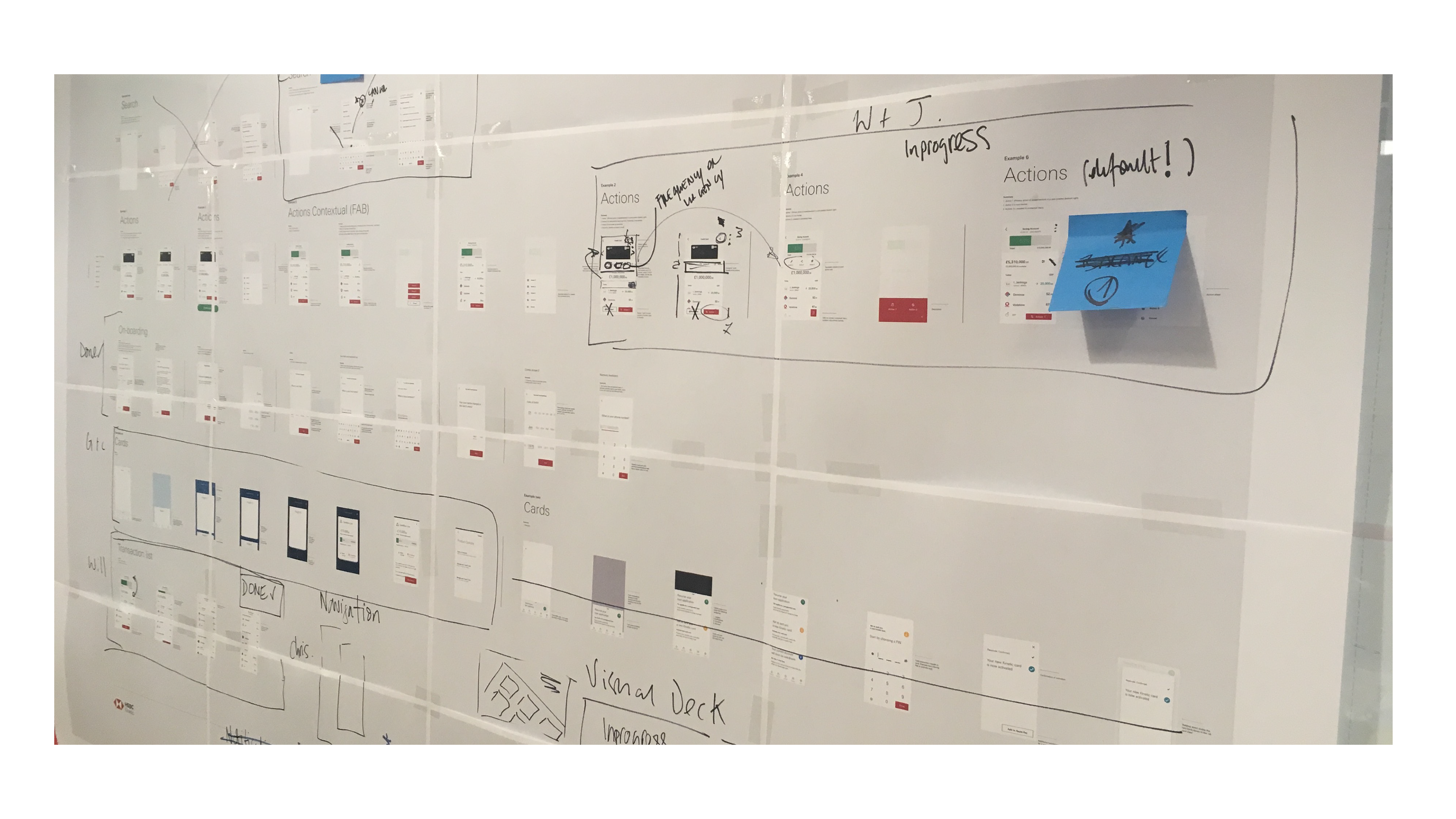

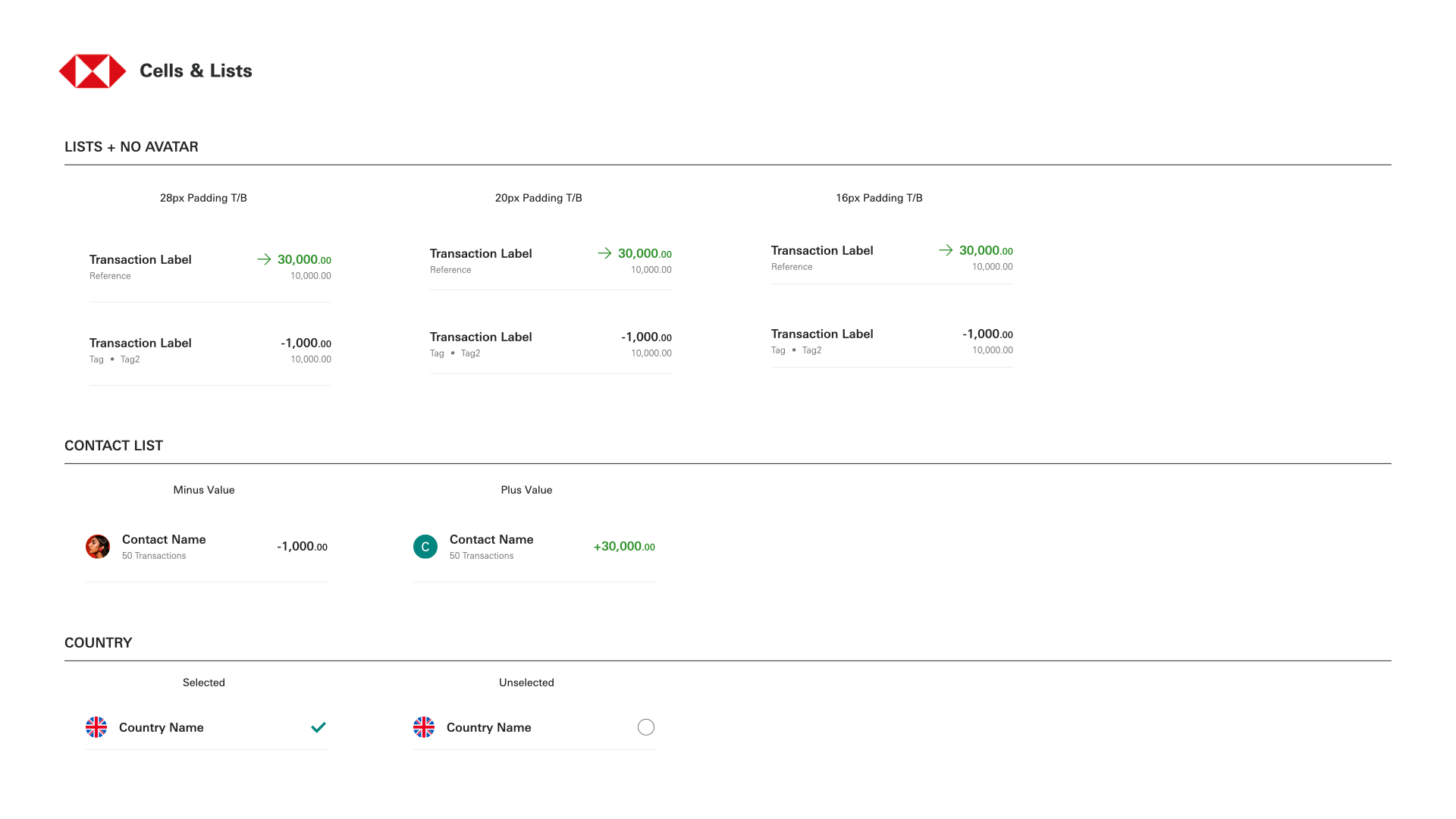

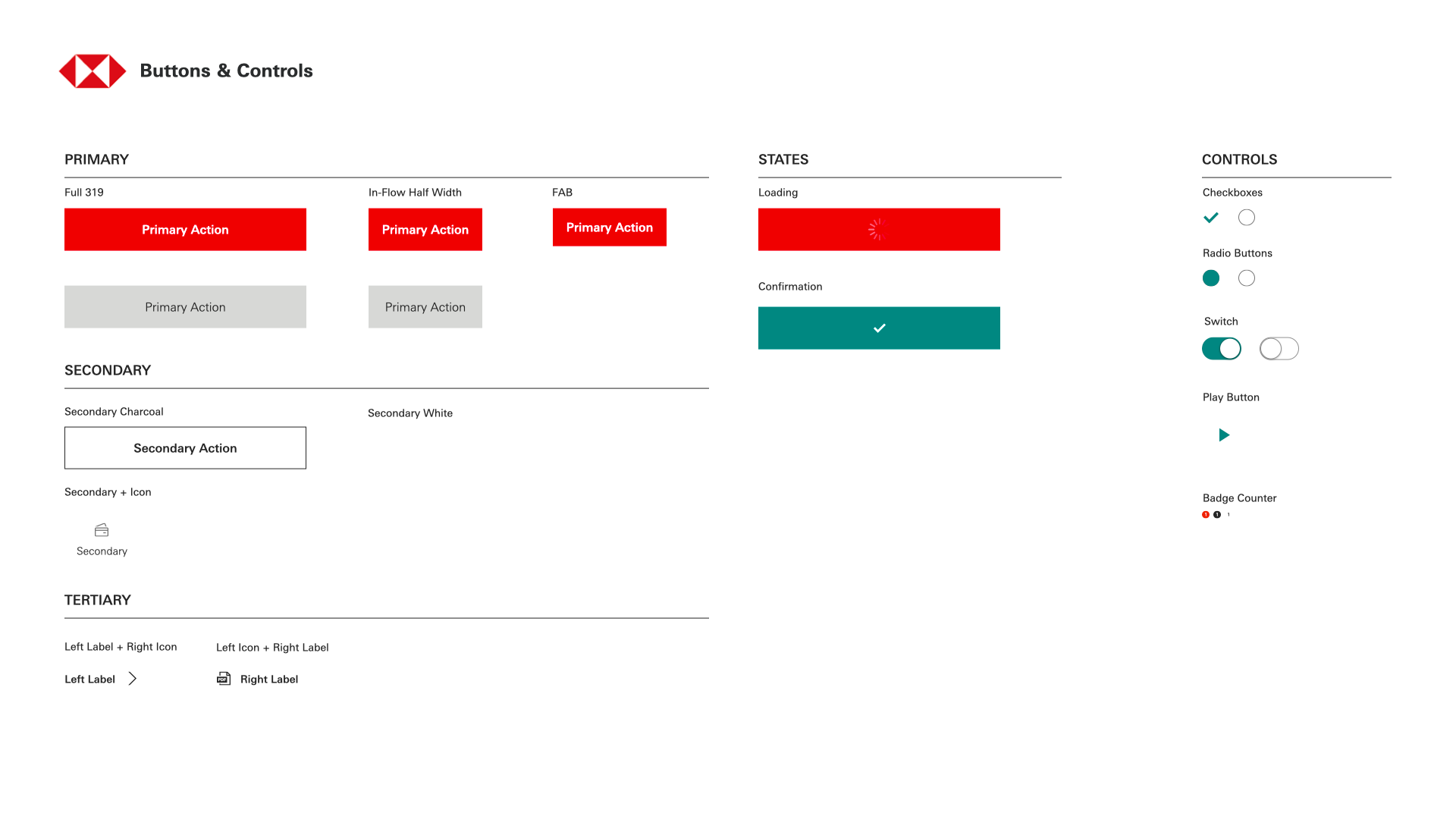

After finalising these core tenets (foundations), components were then created, which would form the initial building blocks that would make up the page templates going forward.

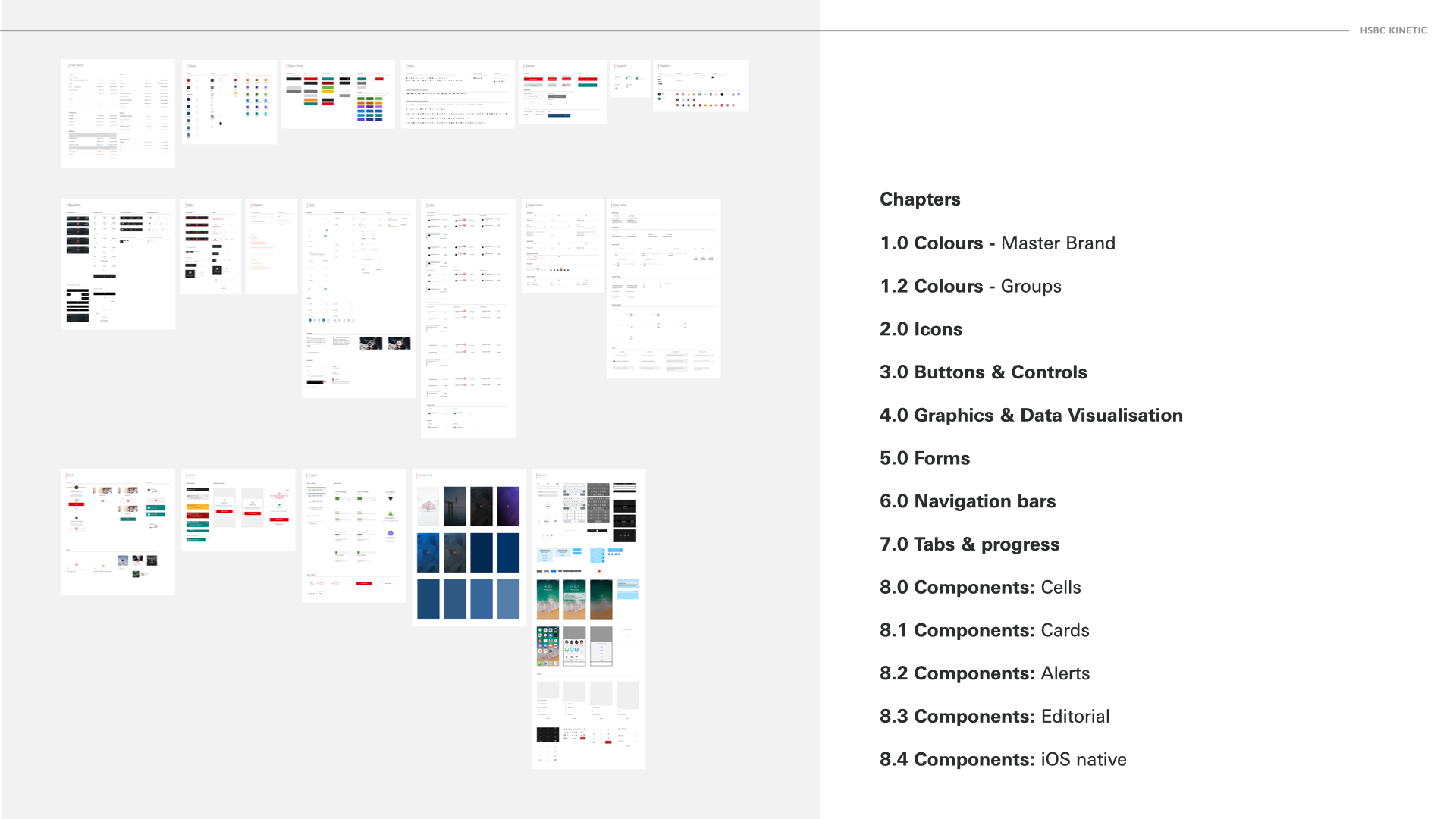

The design system

We introduced a methodology revolving around the use of an “aperture”:

"A window through which we help the customer concentrate and focus on advancing their prosperity."

We referred back to the original brand direction to reintroduce a refined colour palette with white as the primary colour to allow brand moments to occur.

Every use of colour was very significant; we wanted to ensure that colour wasn’t just splashed on the page, but the user knew what each element represented intrinsically.

Refinement of the system

This initiative represented far more than a surface-level UI update—it was a complete overhaul of the entire app. The process began with an in-depth analysis and systematic audit of all existing user flows, carefully evaluating how the new visual design would integrate with current journeys. A critical focus was maintaining—and, when possible, improving usability and ensuring no aspect of the experience became more cumbersome through the redesign.

For instance, we specifically measured performance improvements in key workflows like onboarding, where the new single-question-per-screen approach demonstrated measurable improvements in user completion times compared to the previous multi-question format.

The Kinetic design toolkit was developed as a centralized yet cross-functional effort across all creative teams. Its ongoing evolution was driven by daily design standups, regular reviews, and cross-department meetings to ensure alignment as the product grew in complexity.

Updates were rolled out through structured briefings, guaranteeing every team had access to current standards and could apply them consistently in their work. A live component library bridged the gap between design and development, providing engineers with production-ready assets that perfectly matched the toolkit specifications.

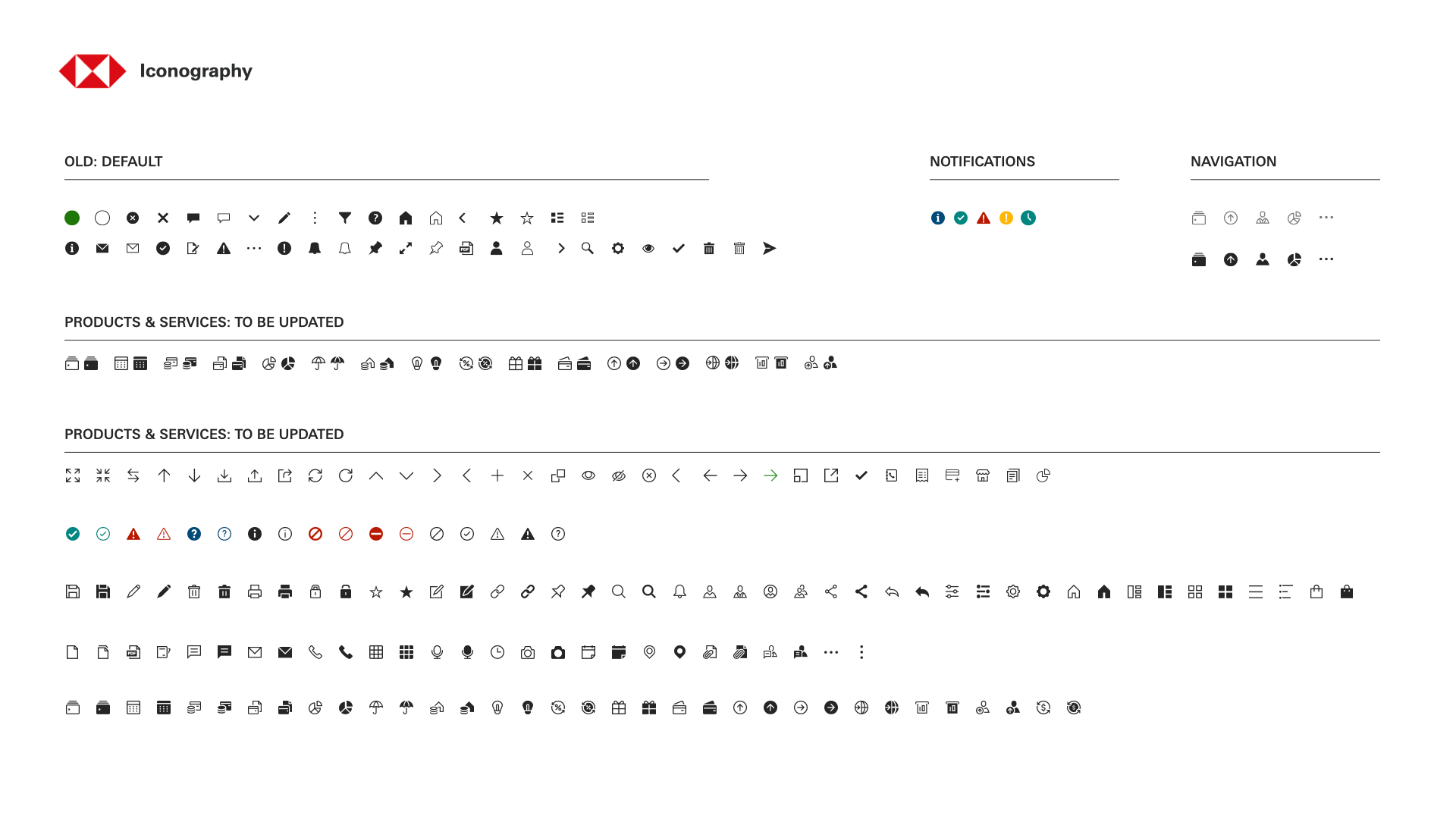

The system comprehensively covered every aspect of the app's design language - from foundational experience principles and UI components to detailed page templates, interaction states, typography, color systems, motion design, iconography, and even tone of voice. This collaborative framework maintained visual and functional consistency at scale and created opportunities for teams to inspire each other's work as the platform matured.

Kinetic Design System

The Kinetic App

Outcome

Following my time on the project, HSBC Kinetic has gone from strength to strength.

Not only redefining business banking for SMEs, but also offering an intuitive, mobile-first experience that simplifies financial management, whether for startups or established businesses looking to switch.

Recognized as the Best App-Based Business Account (Moneynet, 2022–2024), Kinetic delivers tangible value through speed, transparency, and control.

Recognized as the Best App-Based Business Account (Moneynet, 2022–2024), Kinetic delivers tangible value through speed, transparency, and control.

Key Achievements & Features:

Cost Efficiency: A fee-free business current account for the first 12 months reduces overhead for new businesses.

Seamless Transactions: In-app payments of up to £25,000 daily streamline cash flow management.

AI-Driven Insights: Auto-categorized spending and real-time cash flow analytics replace manual tracking, saving hours of admin time.

Convenience: Secure cheque deposits via mobile and international payments across 200+ countries, eliminate branch visits.

Support When Needed: In-app customer service and access to HSBC’s physical branch network ensure businesses never trade flexibility for support.

By combining award-winning digital tools with trusted banking infrastructure, HSBC Kinetic has become a lifeline for SMEs, turning financial complexity into clarity.